FAMILY LIMITED PARTNERSHIP (FLP) LAWSUIT PROTECTION

Utilizing the Family Limited Partnership for Assets Protection:

The Family Limited Partnership is an outstanding ENTITY, VEHICLE for providing the highest degree of law protection for family wealth. When used as part of a properly designed overall strategy, it’s an excellent ESTATE PLANNING benefits when used with an assets protection trust.

The overall structure avoid the cost and expense of PROBATE, it reduces the estate size and lowers income tax by shifting income to lower tax bracket family members. It provides an unsurpassed level of asset protection can be accomplished.

In the old days individuals seek to protect their assets they utilize an (IREVOCABLE TRUST), the problem with such method the individual will lose the control of his assets and he is under the mercy of the TRUSTEE of the IREVOCABLE TRUST.

...

The FAMILY LIMITED PARTNERSHIP, in addition to the assets protection it accomplish the most important need, it gives the individual the complete control of HIS/HER assets, he/she will never lose control or give up control of their assets to a third party.

The FAMILY LIMITED PARTNERSHIP can be used as a very effective Prenuptial / Postnuptial agreement that is very hard or next to impossible for a court to VOID it. It will accomplish the assurance and security of the Prenuptial / Postnuptial agreement and LAWSUIT protection.

The FAMILY LIMITED PARTNERSHIP is Your Legal Shield Against any Predator.

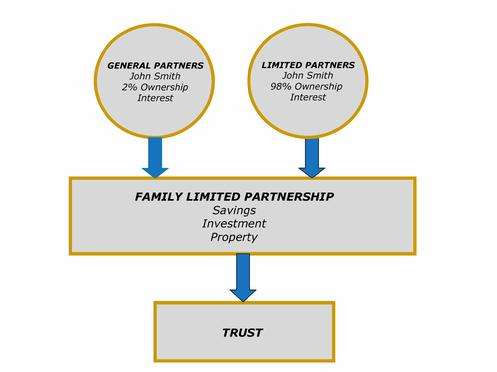

The FAMILY LIMITED PARTNERSHIP formation is similar to Limited Liabilities Company or Corporation, instead of having a President, share holder or manger, it has two OWNERS Called GENERAL PARTNER and LIMITED PARTNER. The most important part of the FAMILY LIMITED PARTNERSHIP is the operating agreement, a well structured agreement that will provide the protection and flexibility you need during your life time and beyond.

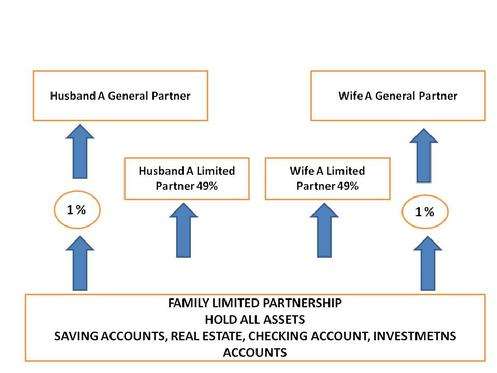

Under normal arrangement, The Family Limited Partnership is set up that the HUSBAND and WIFE are each General Partner and own certain percentage interest of the PARTNERSHIP, the remaining interest are in form of LIMITED PARTNERSHIP interest, owned by the HUSBAND and the WIFE directly or indirectly or any family member depending on the individuals circumstances and their objective.

After setting up the FAMILY LIMITED PARTNERSHIP (FLP), all family assets are transferred into it, including the family home, investments and business interests. When the transfers are complete, Husband and Wife no longer own a direct interest in these assets. Instead, they own a controlling interest in the FAMILY LIMITED PARTNERSHIP (FLP) and it is the FAMILY LIMITED PARTNERSHIP (FLP) which owns the assets.